Daria Milburn | CEM, CEC, EP

03/16/2023 | In this webinar, we explored the various tools in the environmental risk management process, when to use them, and how to react to their findings in a proactive way. As market conditions contract, many regulated lenders are revisiting their environmental due diligence process as they anticipate a wave of delinquent borrowers and distressed assets, and any new lending will be done under a new risk lens.

From upfront questionnaires and desktop reports to Phase I ESAs, Transaction Screen Assessments, and the ever-important review process, we discussed key considerations around each, key risk indicators, and which provides protection under CERCLA.

We also discussed the review process and how to document credit files so you can pass the grade with regulators.

Key topics included:

• Overview of the environmental toolset

• The report review process

• Considerations by report/document type

• Key Risk Indicators

• Credit File Documentation

This webinar is a must for:

Any staff involved in commercial lending, especially community banks and credit unions, including:

• Credit Officers/Senior Credit Officers

• Credit Approvers

• Underwriters

• CRE lending officers

• Head of Servicing

• REO staff

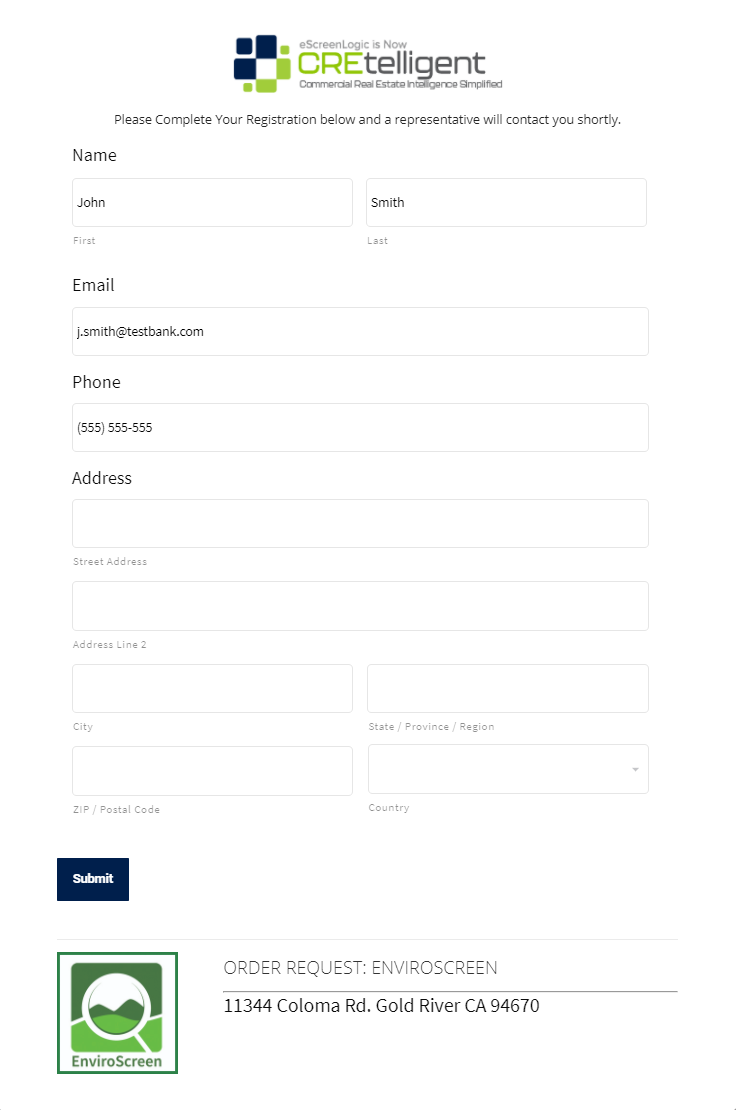

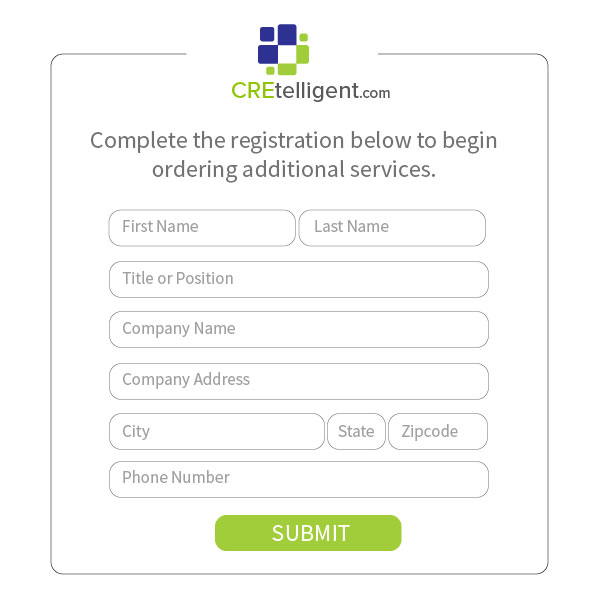

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com