Larry Fink, CEO of CRE investment powerhouse BlackRock, said climate risk is investment risk back in 2020. That statement got its share of attention, including that from the Securities & Exchange Commission (SEC).

Last week (March 6), the SEC issued final rules that standardize climate-related disclosures and reporting by public companies. The rules include requirements for disclosure of carbon emissions and climate-related risks, including climate-related risks to commercial real estate (CRE).

The rules undoubtedly impact public companies owning or investing in commercial real estate. While many top CRE investors and owners have started climate-risk-related initiatives, the new rules call for more transparency, reporting, and planning.

SEC Chair Gensler said, “These final rules build on past requirements by mandating material climate risk disclosures by public companies and in public offerings. The rules will provide investors with consistent, comparable, and decision-useful information, and issuers with clear reporting requirements.

One of the components of the rule calls for public companies to disclose “capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise.”

Other components of the rule required public companies to:

- Disclose climate-related risks that have had or are reasonably likely to have a material impact on their business strategy, results of operations, or financial condition;

- Reveal actual and potential material impacts of any identified climate-related risks on their strategy, business model, and financial outlook;

- Identify processes for identifying, assessing, and managing material climate-related risks and, if managing those risks, whether and how they are integrated into the registrant’s overall risk management system or processes;

- All activities a company takes to mitigate or adapt to material climate-related risks must provide a quantitative and qualitative description of the expenditures incurred and the impacts on financial estimates resulting from these actions;

- A company’s SEC filings, annual reports, and registration statements must include climate risk disclosures rather than solely on its websites.

The new rule will be published in the Federal Register and become effective 60 days following. According to the SEC announcement, compliance dates for the rules will be phased in for all registrants, with the compliance date dependent on the registrant’s filer status. You can read the SEC announcement here.

CREtelligent can help.

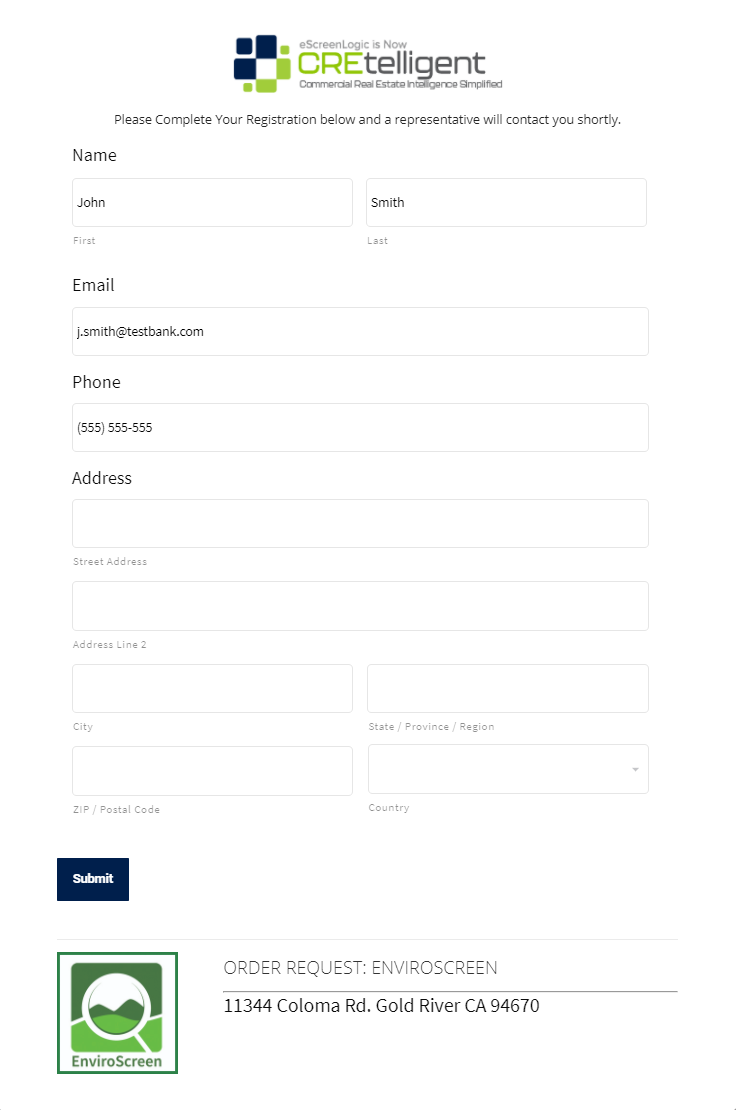

CREtelligent has partnerships with two of the country’s leading climate risk and carbon-related emission planning firms. Contact your CREtelligent representative to see how we can help with your climate risk program or NetZero initiatives.

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com