Anthony Romano | CREtelligent CEO

03/28/2023 | Real estate agents collect a myriad of information to help their clients move smoothly through a transaction. From sales comparables and property information to traffic and neighborhood statistics, the more insights agents provide their clients, the more value they add.

The ability to sniff out anything that could delay a transaction – at least from a property perspective – is critical. However, on most transactions, it is not until later in the game – during loan or deal underwriting – that detailed building inspections, environmental due diligence, flood exposure, and other risks get looked at closely. If you’re a real estate agent, you’ve likely experienced delays in a deal as due diligence caught up with credit and loan approval.

Would knowing earlier in the process help?

When due diligence starts late in the process, it can slow deals down and delay closings. If issues are discovered, it can derail the transaction altogether.

Full due diligence, like appraisals, property inspections, and environmental assessments, can take weeks to complete. These are all prudent means of analyzing property conditions and are almost always required by a lender. As expected, the buyer only wants to pay for due diligence if the deal has a 100% chance of closing.

So how can you anticipate issues if due diligence is delivered late in the game?

CREtelligent has developed the solution with its Early Insights instant property report. Accessing the most reliable and accurate data sets, the report provides the property insights that are most important to you and your clients. And it is highly cost-effective. With it, you get insights into several key categories: building conditions, environmental, valuation, climate, and crime statistics.

Early Insights is ideal for early-stage acquisition or disposition to help determine the appropriate level of due diligence a property will require. With it, you move through a transaction more smoothly and more informed.

Lev Capital, an NYC-based CRE Broker, uses the early insights. “We like to go into a deal with our eyes wide open,” said Daniel Greenblum. “The early insights screen helps us get an initial look at potential concerns. In a CRE transaction, the devil is in the details, and sniffing out anything that may derail or delay a transaction is key.”

Summary: Know Before You Go!

Traditionally, formal property due diligence begins late in the process, during loan or transaction underwriting, after a buyer or seller and their agent have spent considerable energy on the deal. Know before you go! Identifying potential areas of concern early in a transaction and preparing for them can make the difference between a closed or delayed deal.

Recent advancements in data aggregation, machine learning, and AI have made it possible to get instant insights into commercial properties. The Early Insights report is cost-effective and helps real estate agents and their clients anticipate and prepare better for downstream due diligence requirements.

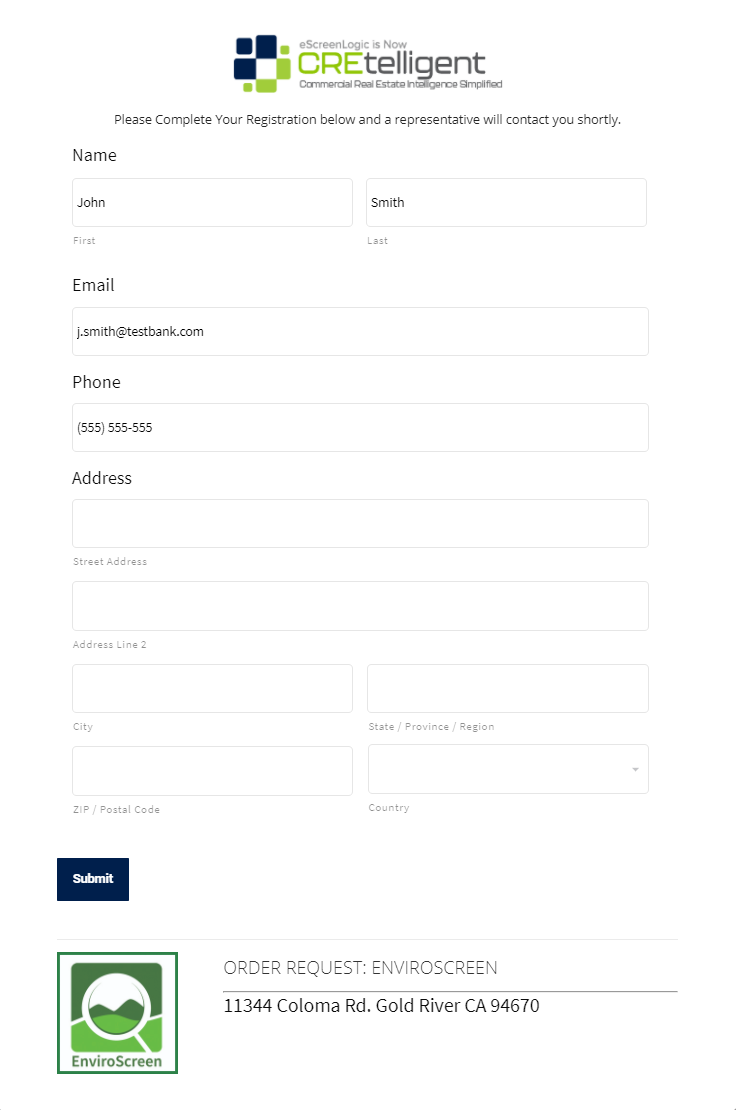

Want more information on the Early Insights report or a sample report?

Click the button or fill out the form below:

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com