5 Things You Need to Know

If you’re a lender originating Agency-backed MultiFamily (MF) loans, working through the nuances of underwriting for both the credit and collateral and making it to closing is no walk in the park. On the collateral, adhering to Fannie Mae’s and Freddie Mac’s guidelines for Environmental Site Assessments is critical. There is no room for error, especially around radon testing requirements. We understand this at CREtelligent.

Last year, the Agencies introduced significant changes to their radon policies, which are crucial for MF lenders to understand and incorporate into their future transactions. Here are five key points about these latest guidelines.

#1 Requirements of Environmental Professional

An Environmental Professional (EP) must manage the radon testing process. The EP must adhere to the Best Practices for Environmental Reports guidelines as published by the Agencies. The EP or a property representative must provide tenant notifications for radon testing.

#2 Expended Scope of Testing

Effective June 30, 2023, radon testing is now required on every Fannie Mae/Freddie Mac mortgage. The 2023 Enterprise MultiFamily Radon Policy requires testing of 25% of ground-contact units, with at least one test per building. State and/or local laws supersede this requirement, and the testing must comply with all state and local regulations and any more stringent Agency requirements. Radon testing is subject to certain exemptions and deferrals for certain property types or loan products.

After completion of the initial radon testing, if any building at the Property has at least 1 unit with an elevated radon concentration equal to or greater than 4.0 pCi/L, the Environmental Professional must either:

- recommend installation of a radon mitigation system to address each unit with a radon concentration of 4.0 pCi/L or above; or

- conduct a follow-up second round of testing within each building having a unit with an initial radon test level at the 4.0 pCi/L threshold or higher, using either short- or long-term testing, and which second round of testing must cover at least 25% of the ground contact units in that building, selected in the Environmental Professional’s professional judgment (but must include each unit that tested at 4.0pCi/L or greater during the first round of testing).

#3 Fannie Mae Structured Data Requirements of Form 4251

The Environmental Professional must deliver the required radon- and property-related data elements specified in the updated Form 4251. The data elements are specified in Appendix A to Schedule 1 of the Multifamily Radon Testing Requirements. You can download the data structure requirements below.

#4 O&M Plan Requirements

Radon to require compliance with an O&M Plan for radon remediation prepared either before or after the Mortgage Loan Origination Date. Any required mitigation system must be managed under an O&M Plan. The O&M Plan must include periodic inspections of all system components by a qualified Property representative.

#5 Exceptions to testing

There are certain exceptions when Agency-backed loan do not require radon testing. These include refinances of properties with existing Agency debt that have undergone previous radon testing and mitigation (if applicable) compliant with the updated radon requirements effective June 30, ‘23; other scenarios include:

- Supplemental loans

- Cooperatives

- Manufactured Housing Communities

- Properties with no ground-contact residential units (including properties with ground-floor retail, first-floor amenities/leasing, or residential units above parking garage or over code-compliant ventilated crawl space)

- Upper-floor residential units

- Any improvements that are not part of the collateral

- Properties with property-wide radon mitigation systems and Operations and Maintenance (O&M) plans in place

- New construction built with radon-resistant measures

- When the EP concludes that testing or mitigation is not necessary and documents reasons supporting this conclusion

Do due diligence right on your Agency loans

If you’re lending on MultiFamily properties backed by Agency financing, not adhering to guidelines on environmental due diligence and radon testing can not only delay closings and possibly kill a deal but could also jeopardize your standing with the Agencies.

The joint Agencies have published best practices for selecting and engaging environmental service providers and those who provide Property Condition Assessments (PCA). You can download a copy of Freddie Mac’s best practices below.

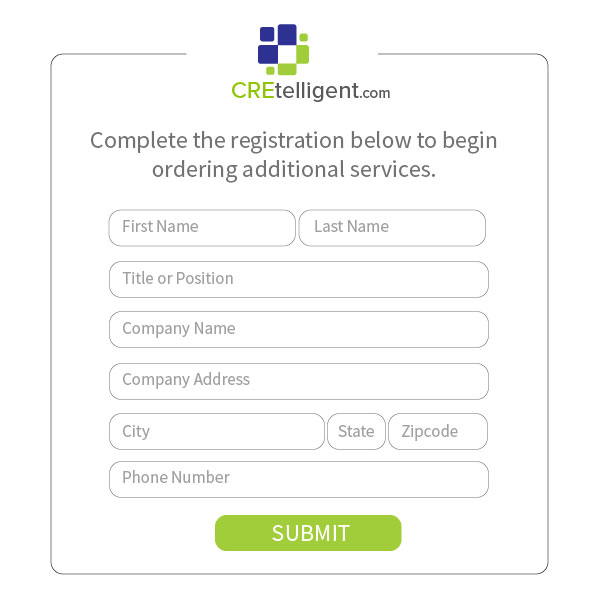

CREtelligent provides both Phase I Environmental Site Assessments and PCAs for lenders financing Multifamily Agency-back loans. Our report templates incorporate the latest data and insights required, are completed by qualified professionals, and support the required data transfer protocols.

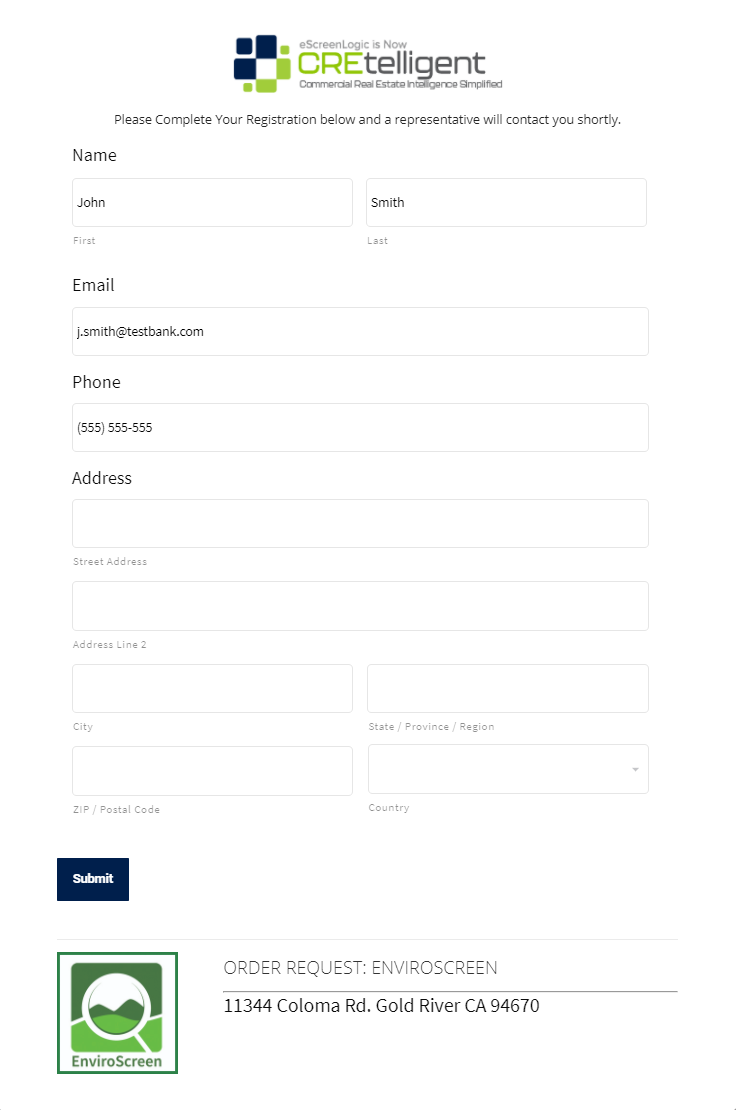

If you want more information on CREtelligent’s Agency Services Team, click the button below.

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.