Daria Milburn | CEM, CEC, EP

01/11/2023 | If you’re lending on commercial real estate, environmental due diligence is an area not to be taken lightly. If you’re relying solely on questionnaires from the property seller or buyer, you may not be doing enough.

Recent regulatory scrutiny around environmental due diligence and the use of questionnaires has driven many Credit Unions to brush up on regulatory guidelines and revisit their lending policies.

This webinar is designed specifically for Credit Unions and will cover the fundamentals of environmental risk management (ERM), including:

- Regulatory NCUA guideline review

- Lending policy development and implementation

- Best practices: developing the risk matrix

- Assessment tools: questionnaires, desktop reports, full ESAs

- Techniques for identifying and mitigating environmental risks

This webinar is a must for:

- Credit Officers/Senior Credit Officers

- Credit Approvers

- Underwriters

- CRE lending officers

- Servicing staff

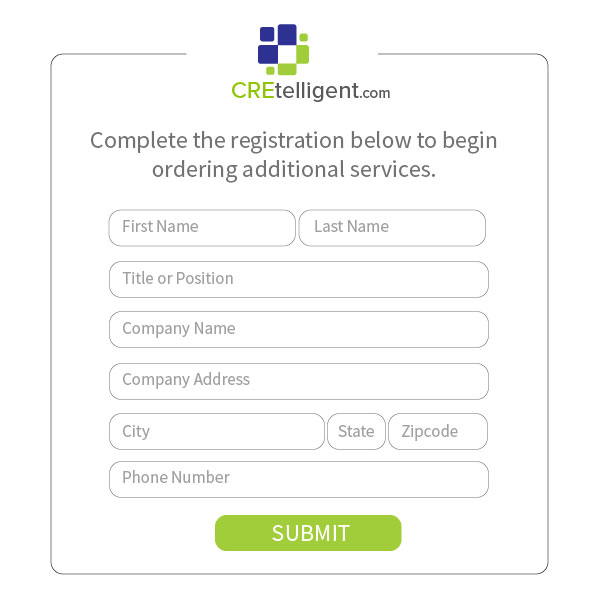

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

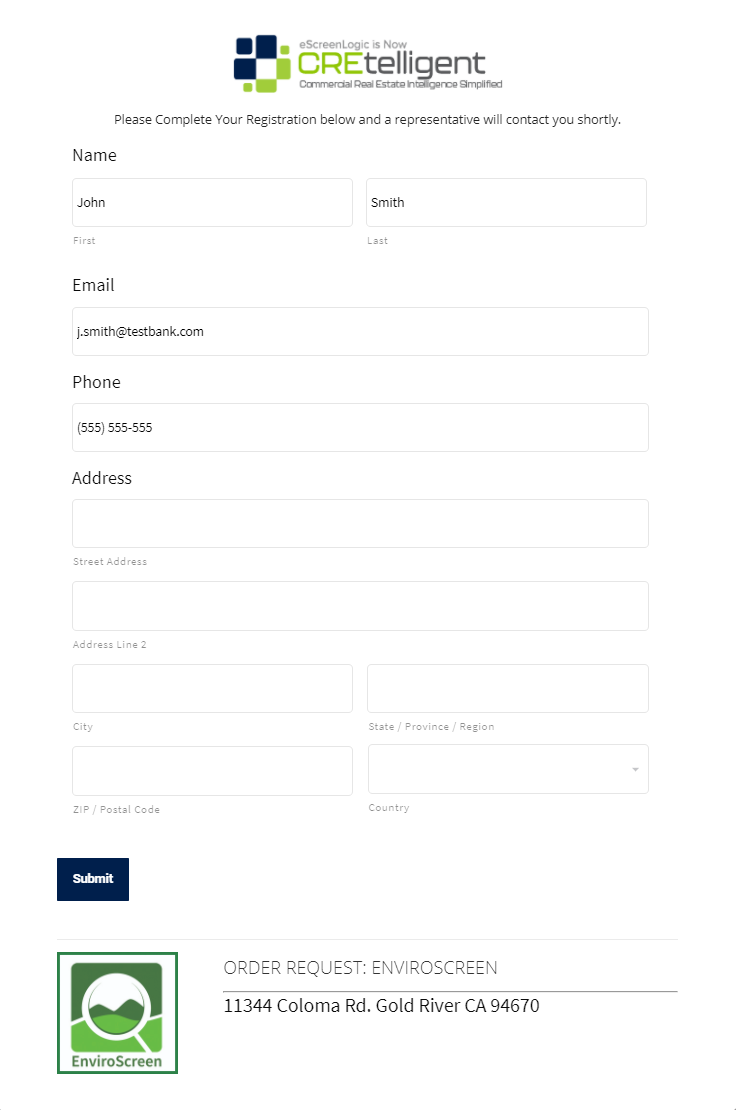

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com