LAS VEGAS, Nevada | 2021

Takeaways from CMBA Western CREF Conference

The sentiment among those attending the CMBA Western CREF Conference in Las Vegas last week was one of cautious optimism for the balance of ’21 through next year, with lots of capital, high market liquidity, plenty of good deals… but no shortages of challenges as we move towards a post-covid underwriting environment.

Lots of Deals, Plenty of Capital Chasing Them

High market liquidity has all lenders – bank, CMBS, life co, debt fund, credit union, private and bridge lenders – all hungry for deals. You can expect an increase in capital deployed to the market across all lenders into 2022. Lenders are extremely busy, with about 75% of the audience raising their hands when asked if they were working on more deals now than last year at this time.

Legislative & Regulatory Update with:

Nema Daghbandan, Geraci, LLP

David Moehring, Union Bank

Mike Flood, Mortgage Bankers Association

Opportunities in Multi Family & Industrial

Multifamily and industrial will continue to get plenty of attention through 2022. In Multifamily, solid demand and a balanced supply will continue to fuel the sector. Agency lenders are hungry for MF deals. Expect MF construction activity and financing to grow in ’22 especially as construction material costs continue to drop from the 200% increase experienced in early ’21. Lenders have the same appetite in industrial, which was minimally impacted by covid, and there’s plenty of capital chasing deals. Industrial assets will continue to be attractive; spreads will continue to compress.

Cautious Optimism in Retail, Office, Hospitality

While there are pockets of opportunity, uncertainty remains in the office and retail sectors. In office, as tenants look to move from long to shorter terms leases and reassess square footage needs there’s still too much uncertainty. As Jason Baker of Pacific Western Bank noted, it’s currently hard to make sense of what office looks like in two years, but also adding that there are some attractive assets such as healthcare and life sciences. He also expects to start looking at hospitality in the near future as borrowers have held on to their assets over the covid downturn. Lenders are seeing some retail opportunities but are cautious as the shakeout from the government covid assistance is still working its way out.

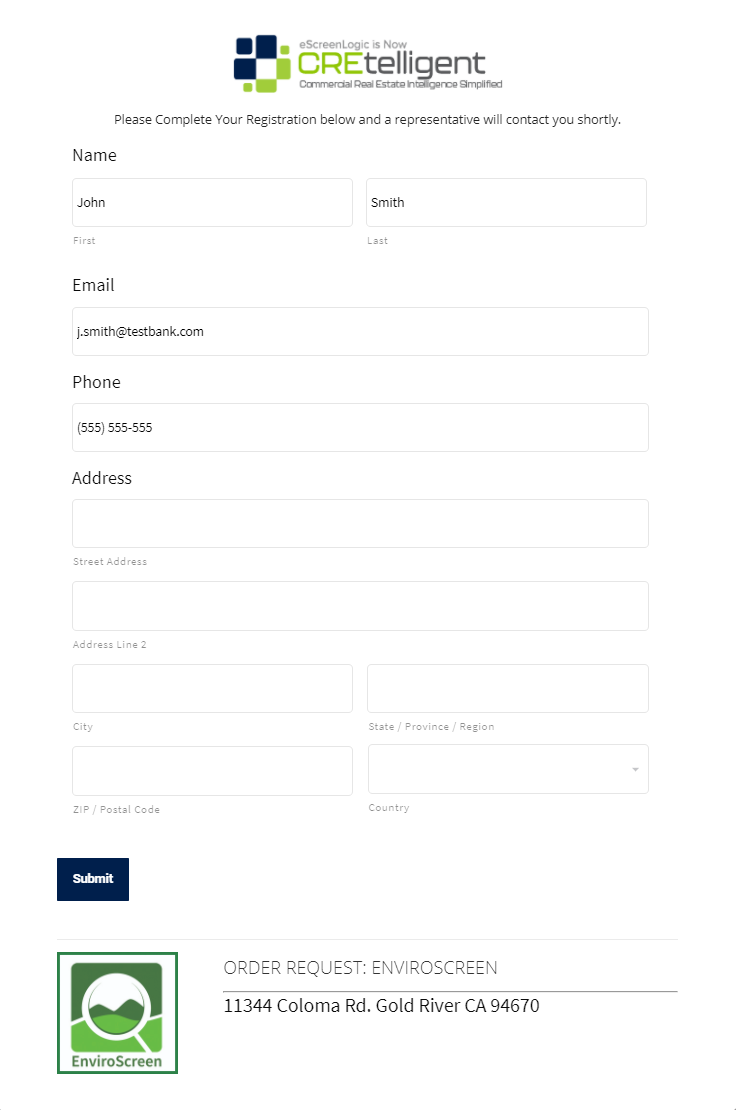

CREtelligent booth at CMBA

The Market is Backed Up

Several speakers noted pandemic-related issues (i.e. site access) combined with a high volume of deals is creating a bit of deal-backlog, with third party reports such as appraisal taking two or three weeks longer than the norm. Lenders also responded well to CREtelligent’s RADIUS platform that streamlines much of the due diligence required for underwriting of commercial property collateral.

Thanks, CMBA!

The consensus among everyone who attended the event agreed it was great to get back out and connect with clients, partners and friends. Hats off to Susan and the team at CMBA for hosting an insightful, informative, well organized, and safe event. We’ll see you back in Vegas next year!

– Gary Kulik

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com