Product Launch: The EPS Suite

A longstanding pain point in the commercial real estate industry is when a deal is disrupted and delayed because an environmental issue comes up after a loan is well into underwriting, or a site has made the shortlist of acquisitions.

The underlying issue seems to evolve around uncertainty and discrepancy around when, how and what environmental due diligence is conducted. But the outcome is often the same: the closing is delayed, the deal breaks down, time is wasted, and not only are your clients unhappy, but everyone else involved in the deal as well.

In lending, at the time of application the borrower’s financial wherewithal is screened using credit agency data to help determine eligibility, qualifying loan programs and help define rate, LTV and other conditions. Once these are defined, detailed underwriting begins based on the specifics of the loan program (i.e Fannie, Freddie, SBA, conventional) and borrower’s credit is further analyzed.

Of course, very early on an appraisal is ordered as collateral value is key to making early lending assumptions, but the environmental is often thought about after underwriting is well underway. And then, many struggle with what level of due diligence to order. Bank policy rules, but the rules are not always clear.

Having an idea very early on about a property’s environmental conditions helps to set expectations for the everyone, but a talk with the seller, or broker, or site walk by a loan officer may not be enough.

Conducting full scale environmental due diligence early in the process isn’t always practical, but with new tools available today, anyone – broker, investor, lender, insurance company – can get an instant view into a commercial property’s environmental condition, and even a risk rating to act on. It is not intended to be an end all, but an easy way to define the next course of action.

A prudent, sensible and cost-effective approach for all parties includes an initial pre-screening to set expectations and next steps, and then the appropriate level of due diligence be it a Record Search with Risk Assessment, Transaction Screen, or Phase I or II. When used at the right time, the pre-screen can help keep those deals moving, transactions closing, and everyone happy.

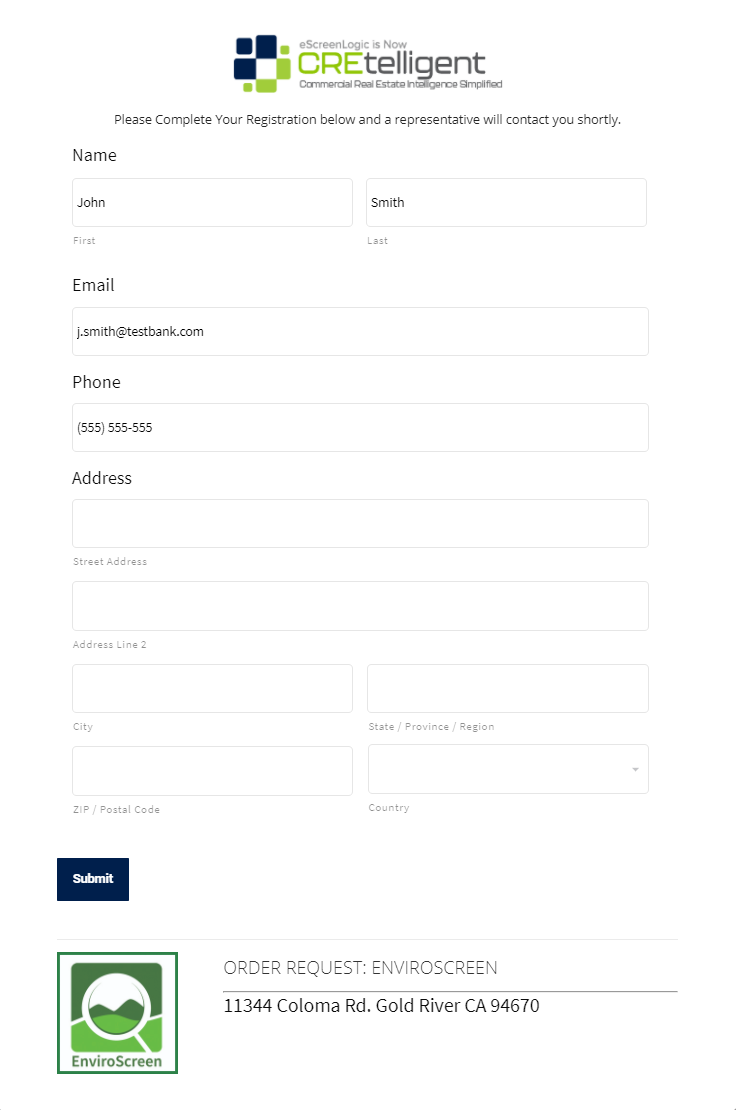

CREtelligent helps solves for this with the EnviroPreScreen Suite (EPS Suite), a set of easy-to-use tools available on the Radius Platform that help CRE professionals quickly and cost effectively determine the level of environmental due diligence required on commercial property. Delivered in under 30 seconds, it provides an instant, at glance view of any concerns on or around a property, a risk rating, and the ability to quickly dive deeper when additional investigation warrants. You can even get an EP’s recommendations in just a few hours.

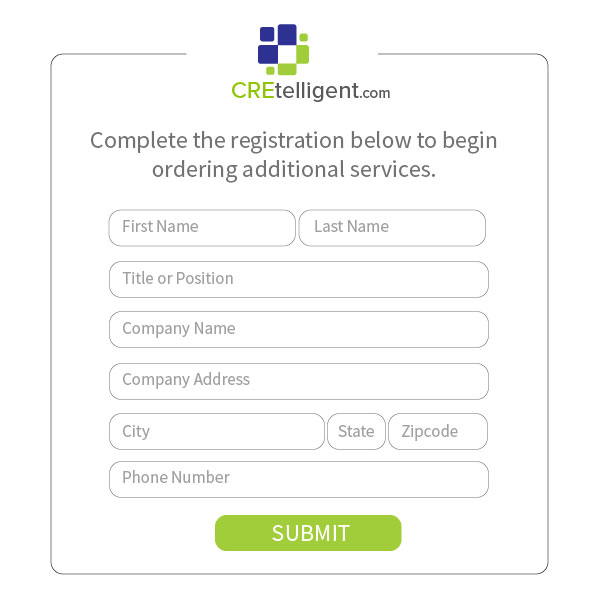

Want to know more about CREtelligent’s EnviroPreScreen Suite or want help with your bank policy?