Did You Know?

There are a lot of CRE Environmental Assessment options for you?

Environmental assessment is compulsory for nearly every lender and required for CERCLA liability protection for every commercial property loan transaction. The term “Environmental Assessment” is a great umbrella heading that points to over a half dozen of different types of environmental property evaluations. But selecting the wrong assessment can substantially increase your risk, eliminate your eligibility for liability protection, and increase both the time and cost of the service. Let me try to demystify and really breakdown the key differences in the options by introducing two key distinctions: DESKTOP REPORT vs SITE INSPECTION REPORT

- Reports generated using information from one or more environmental databases but provide no site visit/inspection = DESKTOP REPORT

- These may be referred to as environmental screens, environmental desktop reports, record search risk reviews (RSRAs), limited environmental assessments, or desktop due diligence.

2. Reports generated using information from one or more environmental databases AND provide information (observations, photos, etc.) from a physical visit = SITE INSPECTION REPORT

- These may include Environmental Transaction Screens (ETS) and Phase I Environmental Site Assessments

I know what you’re thinking, “how do you decide which type of environmental assessment to choose”? Here’s expert advice from our firm.

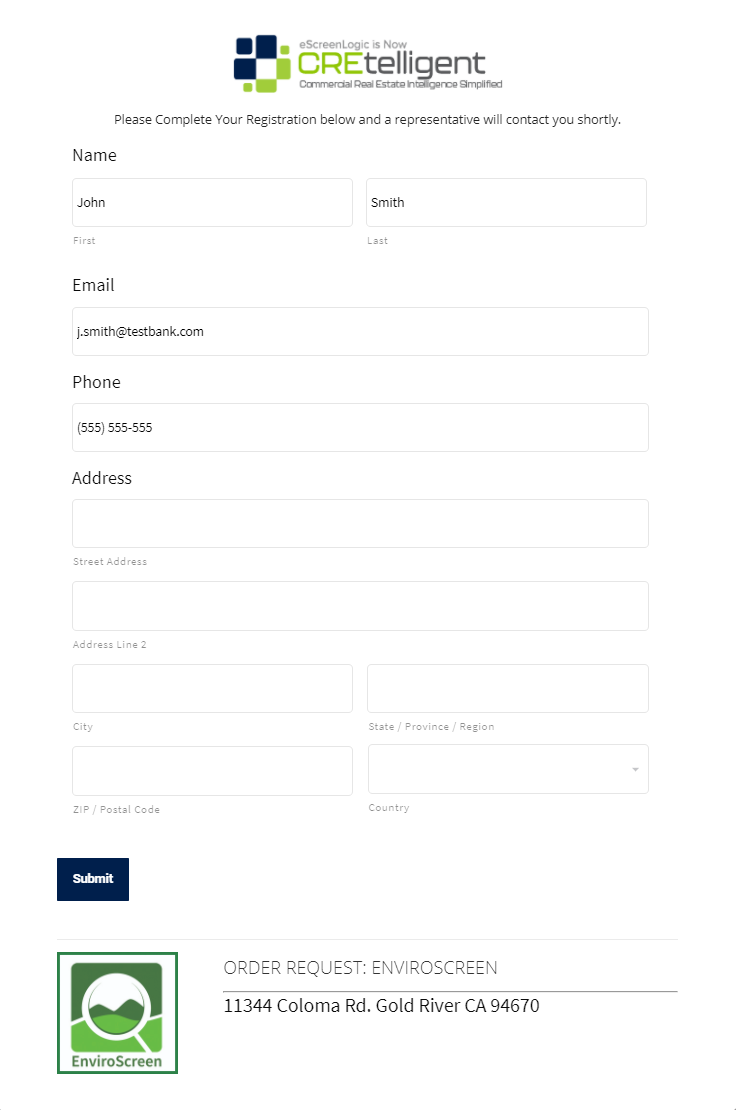

CREtelligent has developed the industry’s leading environmental pre-screen report that provides users an initial understanding of potential environmental concerns quickly and inexpensively for a commercial property. It’s called EnviroPreScreen (EPS).

Let me start by unequivocally stating, EPS is NOT intended to be the final environmental assessment for a commercial property. Its value and use case is truly as a triage tool or decision engine. By reviewing the EPS results of potential environmental concerns for the site and adjacent properties along with using the built-in risk scoring, a user (e.g. broker, buyer, lender, etc.) can make an intelligent decision about what to do next. Think of EPS as the CARFAX report for CRE environmental risk.

So, the first step in deciding which environmental report to use is running and reviewing the results from EnviroPreScreen (EPS).

In addition to running the EPS report, what other considerations should factor into the decision regarding the right environmental assessment? Here’s my top five:

1. Loan Type

- This is top of the list because any SBA 504 or 7(a) Standard loan has a very prescriptive environmental assessment guide. It’s primarily based on NAICS codes and must be followed to have the loan underwritten and approved.

- So, if it’s an SBA loan, you can skip the rest and follow their SOP (see below). If it’s a conventional loan, go to item #2.

2. NAICS Code

- Every business is segmented using the North American Industry Classification System. There are over 1,100 different classifications – 53 of which are deemed “environmentally sensitive industries”. What the heck does that mean? Essentially, any business that uses or stores hazardous material is in one of those 53 industries (think gas station, dry cleaners, printing firms, automotive facilities, etc.)

- So, if the property is classified as one of the 53 (or if the business sells, supplies, or dispenses fuel, gasoline, or heating oil) you can skip any desktop environmental assessment – you’re going to need a Phase I ESA, which uses a physical site inspection to generate the report

3. Historic & Intended Use

- If the business or any previous business on the property stored or used hazardous material at any time, you’ll need to select an environmental assessment that includes a physical site inspection (Phase I ESA).

- Additionally, regardless of the historical use, if the property will be used for a hospice, daycare, school, elderly care or retirement home, or hospital – you’ll also want your environmental assessment to include a site inspection. Given the sensitive nature of the new operations on the property – lenders (and investors) will likely move to a Phase II ESA and sample water, soil, and vapor as part of the process.

4. Loan Amount

- This one seems so intuitive to me, but you’d be surprised how many environmental policies don’t consider loan amount when determining the property environmental assessment. This is all about risk and loss management. The more you pay for a property or lend on a property the more can be lost in a catastrophic situation. If we are talking about loans over $2M, why on earth would you only do a desktop (RSRA) and forego the site visit? Sure, you could save a few dollars (the buyer/borrower since these services are paid for by the buyer), but not uncovering potential environmental hazard or contamination with a site inspection could cost you millions.

- To me it’s a must – but pick your number (loan amount).

5. Interpreted by an Environmental Professional

- The last thing I’d consider when deciding which environmental assessment to use is would you like the report reviewed and interpreted (with recommendations) by an Environmental Professional? Everyone offers an EP’s opinion for their ETS, Phase I, and Phase II reports, but CREtelligent also offers an EP’s opinion on their desktop reports.

- You might ask why anyone would want to run a desktop assessment and not have an Environmental Professional opine?

EnviroPreScreen Reports – A Great Start but likely not the entire race.

CREtelligent’s EnviroPreScreen (EPS) is proving to be a tremendous tool for CRE brokers, lenders, and corporate clients that want a fast, inexpensive, and cursory overview of potential environmental concerns for a commercial property.

Advantages:

- Runs in under 30 seconds from RADIUS platform

- Costs under $50.0

- Subject and adjacent property environmental concern profile (1/8 of a mile)

- Aerial photo with pins depicting open or closed incidents from federal, state, county, or municipal regulatory databases

- Easy to read and includes a risk rating for subject and adjacent properties

Disadvantage:

- Does not include physical inspection of the site

- Does not include a review, interpretation, or opinion by an Environmental Professional

- Does not include review of subject or adjacent property historical records

- Does not meet All Appropriate Inquiry (AAI) and therefor provides no liability protection under CERCLA

When to Use:

- Early in the transaction to understand risk profile, consult with the borrower/buyer and select the proper environmental assessment for underwriting (RSRA, ETS, Phase I, etc.)

- On a regular cadence to see changes in environmental risk of CRE assets held in a portfolio

Thanks for staying with me on this journey – as you can see there are several variables to consider. A bit confused? We get it and are here with in-house Environmental Professionals and an entire team of Client Support and Success Managers standing by to help. Please let us know how we can serve you in your quest to master this and right-size your reporting.