Introduction

When a commercial property exchanges ownership, the seller provides a myriad of information to support the transaction. If the transaction is being financed, lenders also rely on seller-provided input to support underwriting. They’re interested in the past and present use of the property, especially if it was used in what one would consider an environmentally sensitive industry.

Environmental questionnaires from the property owner are relied on for fast and easy assessment of property conditions. However, while cost-effective, they can be somewhat biased or subjective. The seller is motivated to sell the property with the least number of concessions.

The Case of 4903 Forest Drive

In 2014, a new loan request was made on a property – 4903 Forest Drive (pictured). The lender received an environmental questionnaire completed by the seller that stated the property was used as a Health Food Store.

The questionnaire included supporting photos, however only the front of the store was captured, parts of the building were cut off, and photos did not cover the entire property. What it did show in the photos were large windows in the front that appeared to be service bay doors.

An additional site visit was commissioned by the bank, and new photographs showed a former gas station with pump islands and a canopy. The large windows were former service bay doors, and it even appeared the property was an on-site dry cleaner at one time. Flags went up and the deal was delayed.

Seeing the Entire Iceberg

The situation at 4903 Forest Drive is not unique. Like many small balance loans, the underwriting on 4903 Forest Drive required an environmental questionnaire from the borrower. Based on its findings, deeper environmental due diligence would be ordered.

In this case, the completed questionnaire represented just the tip of the iceberg – a health food store.

As properties are repurposed by new owners, especially in the world of retail, having a complete picture of the current and past uses of the property and any associated risk is critical.

Today 4903 Forest Drive is a Freshe Poke restaurant using the former dispenser canopy as a shelter for outdoor seating.

Desktop reports are the next logical step to an environmental investigation, however, advances in technology and data aggregation now allow lenders, buyers, or investors to get instant environmental insights that are accurate, cost-effective, and unbiased.

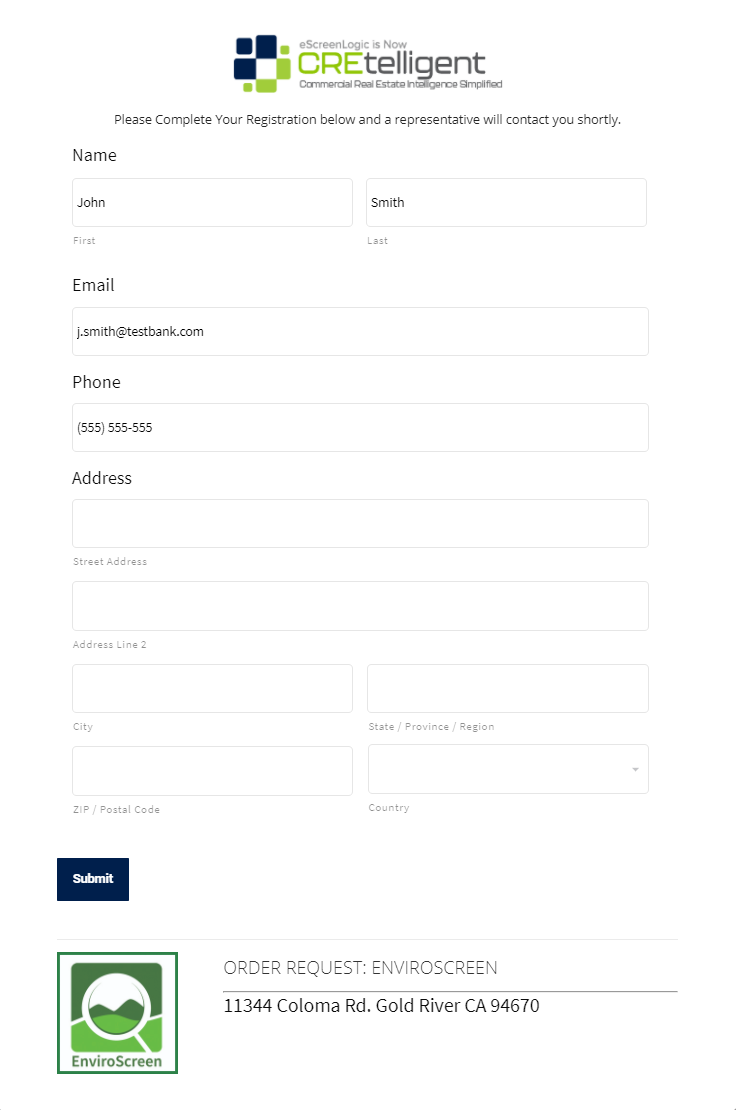

Instant Insights: The Environmental PreScreen

We took 4903 Forest Drive and put it to the test against CREtelligent’s Environmental PreScreen (EPS) report.

The Environmental PreSCreen exposes potential risks based on incidents reported to regulatory agencies and provides a risk rating on each the subject property and neighboring sites. It allows you to see the bigger picture. It can be used to validate questionnaires completed by the seller or as a standalone assessment. It’s analogous to an independent car check report.

In the case of 4903 Forest Drive, the EPS shows:

- Former Service Station

- Underground Storage Tank (UST) Facility

- Leaking UST Incident granted closure in 1999

- Two Facility Registry Listings and IDs

Conclusion

Environmental Questionnaires have been relied on for decades as part of the commercial loan underwriting process. In some cases, especially on small balance loans, they are the only level of due diligence a site might receive. While they are cost-effective and fast to receive, they can be subjective and lack details.

The Environment PreScreen exposes any known potential risk and can be used to validate questionnaires completed by the seller. It’s analogous to buying a used car: you can ask the seller about maintenance history, but you’d be better served getting an independent report. The EPS is the CRE industry’s car check report.

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com